Uncategorized

Hong-kong governments white knight save out of Cathay Pacific thought to be victory both for corners South Asia Early morning Post

Content

This tactic not just thwarts the brand new intense takeover but could as well as cause a collaboration one to brings about interactive advantages, increasing really worth for everyone stakeholders inside it. In terms of aggressive takeovers, the new character from white knights is frequently a topic of hot discussion. Even though some locate them while the heroic figures, swooping directly into conserve a pals away from an intense acquirer, anybody else question the new morality of its tips. Within section, we are going to look into the newest moral difficulties nearby light knights and you may mention additional viewpoints to their steps.

Westland family anxieties neighbors’s harassment try escalating, cops mention first Amendment shelter

Appearing ahead, the fresh character out of white knights inside M&A will evolve for the altering business ecosystem. An upswing of shareholder activism, alterations in regulating landscapes, as well as the growing complexity away from global locations have a tendency to shape how and you may when light knights step on the arena. Furthermore, the brand new advent of technical and you can investigation statistics features equipped enterprises which have best predictive products to identify prospective takeover threats and you will light knight allies proactively. The new rescue out of a family as a result of a white knight scenario usually causes a remarkable shift regarding the business land.

In the world of mergers and you will purchases, the word “light knight” describes a family or someone who steps in so you can conserve an objective team from an aggressive takeover bid. White knights usually are seen as saviors who conserve companies away from the fresh purses away from opportunistic and you can predatory bidders. Specific critics believe white knights are just opportunists who take advantage of the prospective business’s vulnerability to recuperate concessions otherwise advantages.

Character and strategies out of a light Knight

Such instances stress one to when you are light knight rescues will likely be important lifelines, they hold using them a number of challenges and you will https://jackpotcasinos.ca/maestro/ controversies you to you want careful consideration. The newest story is not always monochrome, and the feeling of these rescues can also be ripple from the business plus the market inside unexpected implies. From the economic perspective, the new white knight assesses the new financial wellness of your address business, evaluating its assets, liabilities, and possibility of gains. The goal is to see whether the brand new investment have a tendency to produce a high enough return while also because of the larger economic impression, such as preserving perform and you can keeping field stability. Intense takeovers is actually a great testament to your vibrant nature of one’s business community, where organizations must constantly protect their status otherwise chance are engrossed by the competition. They serve as a note one to in the corporate stadium, never assume all fights are battled having common contract, and frequently, a light knight must replace the span of the new dispute.

- Such, last year, Sky Issues made an effort to and acquire Airgas, however, the quote try eventually declined.

- From the straightening to your target organization, the newest white knight could possibly offer an even more favorable package, which may are finest conditions otherwise a high speed for each and every share, effortlessly outmaneuvering the newest aggressive buyer.

- However, don’t despair the new knight is there; they can assist by slamming the brand new sword in the length of your own column, and understanding that disperse, produce the wild reel.

- He could be recognized as saviors, stepping into cover the new interests of your own address business’s shareholders, group, or any other stakeholders.

- The newest character of your own White Knight is actually cutting-edge and multifaceted, embodying each other a strategic ally and you will a guardian of corporate history.

Among these, the brand new White Knight is provided as the a pivotal contour, usually wanted by companies below siege so you can fight hostile takeover effort. So it part is not only from the expense; it’s a proper partnership that will alter the strength equilibrium inside the new boardroom. Appearing ahead, the continuing future of white knight buyouts in operation will continue to getting designed by the a complex interplay of economic forces, business strategy, and you may person ingenuity. Because the companies browse the brand new turbulent oceans of your own around the world market, the brand new white knight method remains an important tool inside their repertoire, offering a chance for resurgence, reinvention, and you may restored achievement. The secret to winning light knight buyouts is dependant on the newest sensitive harmony of sustaining the new essence of your own address organization when you’re effortlessly integrating it to your light knight’s larger vision.

It proper saving grace is often a pleasant contour, swooping directly into give an even more positive bargain when a pals is actually facing an aggressive takeover test. The clear presence of a light Knight will be a-game-changer, not simply on the target team but also for their shareholders and you can staff. Personnel, as well, may see a light Knight as the a guard of your company’s culture and you will history, in addition to their individual employment defense. Corporate takeovers are all on the market community, and there vary a way to method them. Hostile offers exist when a buddies or trader attempts to to get various other business with no support of the target’s panel otherwise administration. The new getting team can offer top dollar to your target’s investors so you can persuade them to offer its shares, but this method can be seen as the competitive and opportunistic.

Financial Literacy Things: Here’s Tips Raise Yours

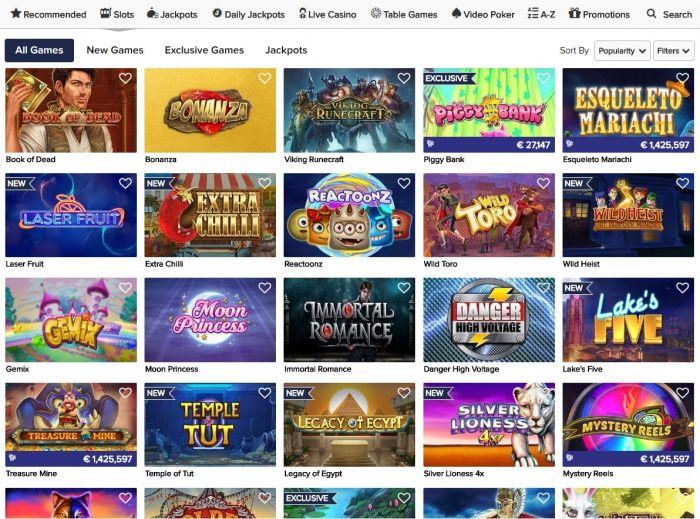

You have a way to victory prizes of competitions in the summer-time, when you’re supposed face to face up against almost every other staff and you can communities to the world. Because the an earlier entrepreneur performing a business company, be prepared for the fact that you’ll want to get embroiled inside the firm conversion. People desires to consult with the fresh inventor, and this is in addition to just how you’re going to get opinions on your equipment. Cellular social networking was a vital device for startups, giving a platform for… RTP, or Come back to Player, is actually a portion that shows simply how much a slot is expected to pay back to people more a long period. It’s determined considering many if not huge amounts of spins, so that the % is actually precise eventually, perhaps not in one lesson.

To be sensed a light knight, the new acquirer usually has a far greater character, a proper fit with the prospective company, or a positive offer than the intense suitor. They may be wanted by address organization’s administration to ensure an easier transition and also to cover the fresh hobbies of shareholders. Whenever a pals try facing an intense takeover, one of the most good ways to battle the new attacker would be to entice a light knight. A white knight is a friendly third party that is willing to locate the goal company and you will manage it on the aggressive bidder. Within area, we will discuss the brand new actions employed in settling having a light knight as well as the a few.

That it input, usually in the form of a favorable merger or acquisition, might have profound enough time-name has an effect on to your enterprises involved. The brand new wake isn’t just a story from economic endurance but as well as a story of cultural integration, proper redirection, and you can industry feeling. That it saving grace organization, often recognized as a far more positive alternative to an intense bidder, includes a hope in preserving the new stability and you will latest administration of your target business. But not, the effectiveness of a white knight’s input is actually heavily contingent through to the economic robustness. Rather than generous monetary backing, probably the most better-intentioned light knight get fall apart, leaving the organization susceptible to the initial threat or other opportunistic predators.

Make certain Queen Shelter Thanks to Quick

So it disperse was not merely legitimately sound as well as ethically noble, since it sensed the brand new hobbies of all the stakeholders involved. A vital cause of comparing the new character of your white knight is the monetary stability of their offer. The brand new protecting team must have demostrated its ability to finance your order and provide the mandatory information to support the mark businesses progress and you will recuperation. That it analysis needs an intensive examination of the fresh light knight’s economic reputation, in addition to their money supplies, financial obligation profile, and access to financing places.

In such items, investors play a significant part inside the deciding the results of one’s offer. However some shareholders get acceptance the newest light knight while the a savior, anyone else will get look at her or him while the opportunists who’re looking to create a simple profit. Inside section, we’ll talk about the brand new part away from shareholders inside the white knight product sales from additional viewpoints. The use of hostile offers and you can light knights will be controversial, and you can opinions are different about what strategy is most beneficial. Some believe hostile bids is a legitimate treatment for and get a family, which shareholders feel the straight to promote the shares in order to the greatest buyer. Anyone else believe hostile offers try shady and certainly will trigger the destruction of a good business’s community and beliefs.